Banking Use Case

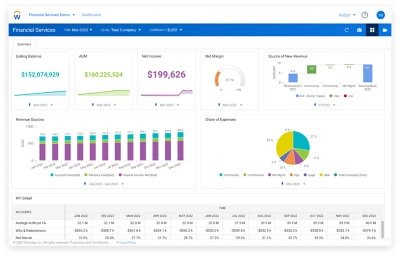

Modern planning built for the rapidly changing banking industry.

Â鶹´«Ã½ Adaptive Planning gives banking organizations the power to plan, budget, and forecast the future.

Key use cases.

Explore models built for the banking industry.

-

Balance sheet planning¡ªBuild loan portfolio runoffs, including principals, prepayment, interest, deposits, fees, as well as new origination/deposit models so you can forecast a comprehensive balance sheet, income statement, and cashflow.

-

Product and branch profitability¡ªPlan revenues and direct costs by product and branch. Allocate personnel and overhead to create product and branch P&Ls.

-

Non-interest expense budgeting¡ªPlan for non-interest expense items such as salary, benefits, taxes, and facilities costs.

-

Funds transfer pricing¡ªAdjust rates to determine the profitability of product lines or performance of various branches.

-

Workforce planning¡ªBuild branch and call center staffing models to optimize capacity; plan related benefits, bonuses, commissions, and raises.

-

Assets under management (AUM)¡ªWealth management companies can plan assets under management (AUM) and advisory fees.

-

Credit union membership¡ªCredit unions can forecast member adds, retention and fees as well as instrument-level details (e.g., credit cards, car loans, and mortgages).

Ready to talk?

Get in touch with us.